The Rise of Cryptocurrencies and the Emergence of Decentralized Exchanges (DEXs): Revealing the Latest Trends in the World of Digital Assets

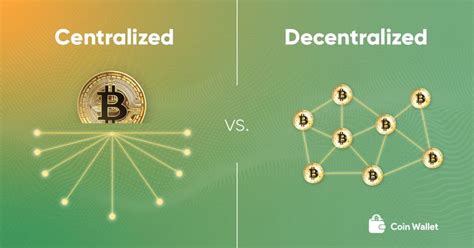

In recent years, the world of digital assets has seen a significant surge in popularity, fueled by the emergence of cryptocurrencies such as Bitcoin, Ethereum, and others. One of the key factors contributing to this growth is the increasing adoption of decentralized exchanges (DEXs), which have revolutionized the way people buy, sell, and trade cryptocurrencies.

What are Decentralized Exchanges (DEXs)?

A decentralized exchange is an online platform that allows users to trade assets without the need for intermediaries such as brokers or exchanges. DEXs operate on blockchain technology and enable secure, transparent, and efficient transactions between buyers and sellers.

The Benefits of Decentralized Exchanges

- Security: DEXs use advanced cryptography and smart contracts to ensure secure transactions.

- Accessibility: Anyone with an internet connection can participate in trading on a DEX, regardless of their location or financial situation.

- Liquidity: DEXs offer instant settlement and allow users to buy and sell assets quickly and efficiently.

The Rise of Cryptocurrencies

In 2009, Bitcoin was launched as the first decentralized cryptocurrency, followed by other popular cryptocurrencies such as Ethereum, Litecoin, and Monero. Since then, the global cryptocurrency market has grown exponentially, with new coins and tokens being launched at an unprecedented pace.

What is a reversal pattern?

A reversal pattern is a specific type of chart pattern in technical analysis that indicates a potential change in market direction. It involves identifying a trendline or support/resistance level that the price has previously bounced off of, and then predicting that it will eventually return to that level.

The Role of Decentralized Exchanges (DEXs) in Reversal Patterns

In recent years, DEXs have played a crucial role in identifying reversal patterns. By providing a platform to buy and sell assets without intermediaries, DEXs allow traders to quickly make trades and monitor market sentiment. Therefore, many technical analysts believe that DEXs can play an important role in identifying reversal patterns.

How Cryptocurrencies Are Traded on Decentralized Exchanges

Cryptocurrencies are traded on decentralized exchanges (DEXs) using the same cryptographic techniques as traditional fiat currencies. To buy or sell cryptocurrencies, users must create a digital wallet and pair their cryptocurrency with an exchange that supports trading.

Some popular DEX platforms include:

- Binance: One of the largest and most well-known DEX platforms.

- Uniswap: A decentralized liquidity pool platform for exchanging various cryptocurrencies.

- SushiSwap: Another popular DEX platform known for its high liquidity and user-friendly interface.

Conclusion

The advent of decentralized exchanges (DEXs) has revolutionized the way people trade cryptocurrencies. By providing a safe, accessible, and efficient platform for trading, DEXs have enabled individuals to participate in the global cryptocurrency market without intermediaries. As technical analysis continues to evolve, we can expect to see even more innovative uses of DEXs and the emergence of new technologies that will further improve the user experience.

Cryptocurrency Exchange Comparison Chart

|

Exchange |

Minimum Deposit |

Fees |

Liquidity |

| — | — | — | — |

| Binance | 10,000 BNB | Low to Medium | High |

| Uniswap | No Minimum Deposit Required | Low Fees | High Liquidity |

| SushiSwap | No Minimum Deposit Required | Low fees | Medium liquidity |

Note: The fees listed are indicative and may vary depending on the specific transaction.